Despite a rebound in imaging volume, radiology administrators are concerned about rising costs for staff like radiologic technologists, according to survey results for the third quarter of 2021 in the Medical Imaging Confidence Index (MICI).

As a result, radiology administrators and managers have declining optimism that their internal operating and staff costs will remain constant, according to the new MICI numbers. What's more, many reported that staffing and recruiting have become one of their biggest operational challenges.

"Lack of adequate staffing is our major and number one issue," one MICI respondent reported.

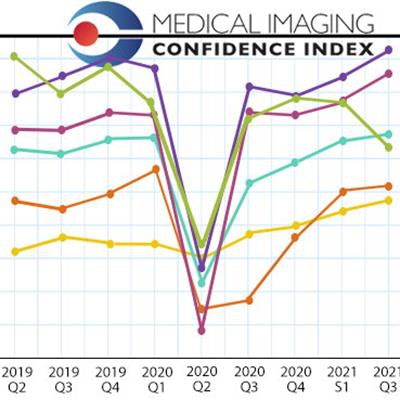

The MICI is derived from survey responses of imaging directors and hospital managers who are members of the AHRA, the association for medical imaging management. Market research firm the MarkeTech Group queries members of the MICI panel about five important trends faced by radiology administrators and business managers in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects.

For the 2021 third-quarter data, the index included 152 participants from across the U.S., with 14% based in the Mid-Atlantic region, 15% in the South Atlantic region, 7% in the East South Central region, 20% in the East North Central region, 16% in the West North Central region, 11% in the West South Central region, 7% in the Mountain region, and 11% in the Pacific region.

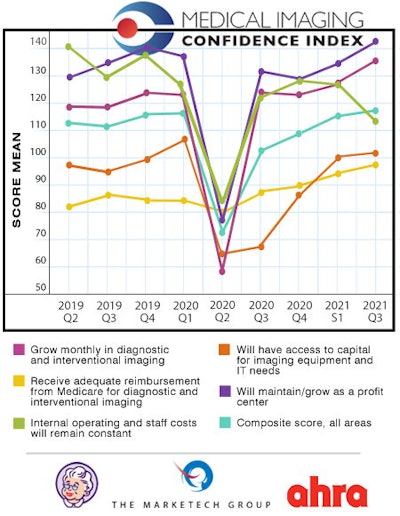

Participants were asked to rate their optimism about five topics, and a single composite score including all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

The MICI survey respondents were most optimistic that they would grow as a profit center, with a score of 142, and also that they would grow monthly in diagnostic and interventional radiology, with a score of 136.

But their confidence that their internal operating and staff costs would remain constant registered a score of 113, compared with a score of 127 in the MICI survey for the first half of 2021. They were also less confident that they would have access to capital, with a score of 101, and that they would get adequate Medicare reimbursement, with a score of 98. The composite MICI score for the third quarter was 117, compared with a composite score of 115 for the first half of the year.

| MICI scores by topic for third quarter of 2021 | ||

| Topic | Mean score | Interpretation |

| Will maintain or grow as a profit center | 142 | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 136 | Very high confidence |

| Internal operating and staff costs will remain constant | 113 | High confidence |

| Will have access to funds for imaging equipment and IT | 101 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 98 | Neutral |

| Composite score across all topics | 117 | High confidence |

The MICI scores for the third quarter of 2021 and their relationship to the previous eight reporting periods are shown in the following chart.

In the free-response section of the survey, members of the MICI panel expressed their hopes and fears for the coming quarter. Staff issues were prominent among these, with several survey respondents noting the difficulty they were having in recruiting and retaining qualified radiologic technologists.

"Recruiting [is] a significant challenge, so internal costs will increase due to increasing wages, recruiting bonuses, relation assistance, retention bonuses, and referral bonuses," one respondent stated.

Other respondents confirmed that technologist wages were rising rapidly, and another reported that they were having trouble recruiting technologists for all modalities, even radiography.

At the same time, demand for imaging services is increasing, growth that is challenging to meet with fewer caregivers. Other respondents confirmed that imaging volumes are growing again, with some MICI respondents reporting that they had returned to levels seen prior to the COVID-19 pandemic.

But there has been a downside to the rebound caused by the delay of imaging exams caused by the pandemic.

"Because of the gap in care/fear of coming in to a healthcare setting, many conditions have become exacerbated, requiring advanced modalities/procedures," one respondent noted.

MICI is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm the MarkeTech Group.