The rising global incidence rates of breast cancer, coupled with the severe backlog of women requiring breast cancer screening appointments due to COVID-19, has reinforced the importance of women's health and early detection of cancer.

According to the World Health Organization (WHO), breast cancer has surpassed lung cancer as the most diagnosed cancer worldwide, with an estimated 2.3 million new cases and equating to 11.7% of all new cancers in 2020. Breast cancer also was responsible for just under 690,000 deaths globally in 2020.

Global drivers of the breast imaging market include strengthened awareness on the benefits of breast cancer screening programs and the need to improve the accuracy of breast cancer detection. This, alongside a patient-centric approach to screening and technological advancements to enhance patient comfort, are improvements being implemented to increase participation of screening programs which in turn has driven the uptake of mammography x-ray equipment.

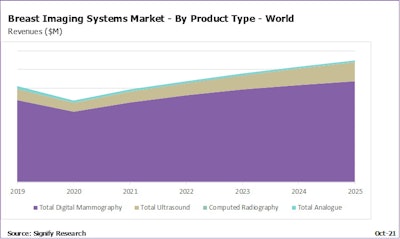

Global breast imaging market ($m).

Global breast imaging market ($m).The world market for breast imaging equipment is forecast to reach almost $1.3 billion by 2024 with the breast imaging AI (artificial intelligence) market forecast to reach $205 million. However, the mammography and breast ultrasound market revenues declined by just under 15% and 18%, respectively, in 2020.

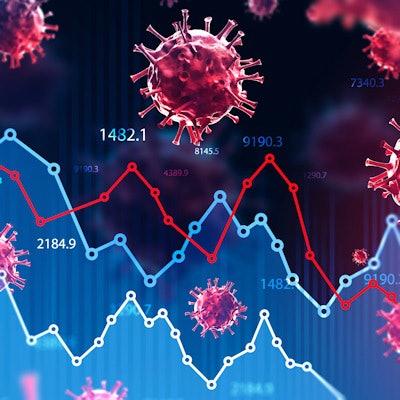

The impact of COVID-19

COVID-19 has severely impacted all medical procedures and healthcare facilities since the pandemic was declared globally in March 2020. Breast screening was significantly affected, with a high number of women missing scheduled mammograms.

In the U.S., the Centers for Disease Control and Prevention (CDC) reported that in April 2020, as the country was largely shutting down, 80% fewer screening mammograms were conducted compared with the average number of mammograms in April in the previous five years. With such a significant population of women missing screening appointments, there is a big concern that many more women will develop later stages of breast cancer in the coming years as a result.

However, to help deal with the patient backlog, significant investment will be needed in both medical staff and breast imaging equipment. With increased pressure of screening centers and hospitals to address the number of women requiring breast cancer screening, there is heightened interest in how AI can be used to help prioritize scans, by highlighting suspected cases or lesions. Cases that are most urgent can then be addressed as a higher priority within the radiologists' workflow and accelerate patient care pathways or protocols for further diagnosis.

These four key trends are affecting the market:

Use of 2D vs 3D mammography in screening programs. The U.S. is the only country that currently uses 3D mammography for screening, with all other countries only using this technology for diagnostic purposes. Western European countries are expected to be the next to adopt 3D mammography screening programs, but this is not anticipated to happen until the next two to three years.

Changes in demographics of women being screened. Healthcare providers are considering changing breast cancer screening policies to include younger demographics to help reduce breast cancer related deaths and increase early detection. However, the possibility of overdiagnosis and false positives is still prevalent.

Personalized risk-based screening. The extensive number of factors that could contribute to the risk of breast cancer include genetics, family history, polygenic risk scores, and high mammographic density. Personalized risk-based screening may also identify high-risk women for more intensive screening such as MRI follow-up after mammography; alternatively, low-risk women may be more suited to longer intervals between screening, which also reduces the risk of false positives through overscreening.

Use of multimodality imaging for breast cancer screening. Movement toward risk-based screening is likely to encourage the use of multimodality imaging. As women are segregated into groups, identified factors such as increased breast density are expected to facilitate supplemental screening, which is not commonly practiced today.

Overall, there continues to be a significant discrepancy across the world with regards to screening programs. Countries with large populations, like China and India for example, do not have a formal, structured approach to screening. There are also large differences in participation even in regions where formal programs exist, such as in Western Europe. In Spain, Denmark, and Finland, there is around 80% participation, whereas participation rates in other countries like France, the DACH region, and Portugal are all significantly below the 50% mark. The European Union is attempting to increase participation and move the adoption rates to 80% or above.

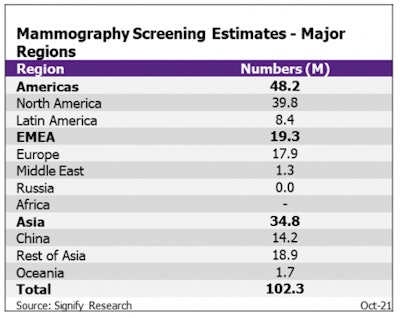

Mammography screening estimates -- major regions.

Mammography screening estimates -- major regions.As a result of the countable rise of breast cancer incidence globally, there are heightened pressures for government screening programs. However, screening programs alone are not sufficient to help tackle breast cancer mortality rates. It is essential that the accuracy of breast cancer detection is improved, while false positives and missed lesions are also reduced. These factors are forecast to be at the forefront of advancement in breast imaging for both screening and diagnosis.

Looking to the future

Mammograms will continue to play a fundamental role in the detection of breast cancers, but the occurrence of false positives often leads to benign lesions being operated on. With heightened pressures for breast cancer screening programs to account for the rising female population qualifying for mammography screening, it is crucial that the number of false positives subsequently does not rise as a result. Advanced techniques in mammography screening such as artificial intelligence, tomosynthesis guided biopsy, and contrast-enhanced spectral mammography, as well as a more personalized approach to breast cancer screening are initiatives that could help reduce the number of false negatives or positives and drive more accurate early detection of breast cancer.

Bhvita Jani is senior market analyst at Signify Research. For further information, go to " Breast Imaging – World Market- 2021." The report provides a regional and global outlook on the current and projected uptake of breast imaging devices, including analysis of the product mix, regional variations, competitive landscape and vendor market shares.