After years of healthy revenue growth, but otherwise stagnant market and competitive activity, the U.S. radiopharmaceutical sector is poised for rapid and revolutionary change.

Nuclear medicine has enjoyed a long and solid history. Many of the radiopharmaceuticals in use today were originally introduced as much as 40 to 50 years ago. Innovation has come in waves, however, with periods of stagnation followed by a deluge of scientific creativity.

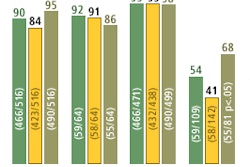

The last three to four years has witnessed a slowing of innovation. Ironically, the U.S. market has still held its own, generating more than $900 million in revenues in 2001, with an annual growth rate of 12%. The statistics highlight a surprisingly positive story for a mature sector characterized by a lull in new product introductions. With major innovation predicted in the future, it's easy to predict an outlook of significant growth.

Current conditions

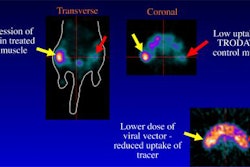

The current radiopharmaceutical market is composed of diagnostics, such as FDG, and therapeutic agents used to diagnose or treat a number of diseases and conditions. Radiopharmaceuticals, assisted by the increased sophistication of nuclear medicine technologies, are rapidly becoming tools that support the continuum of care, rather than providing a single point-of-care application.

Commonly used in PET imaging, FDG is a shining example of this trend. PET has quickly moved to encompass not only the initial diagnosis or confirmation of disease, but also the assessment of the efficacy of treatment for certain cancers. This ability generally leads to improved patient outcomes, treatment efficiency, and cost savings due to potential reductions in the amount of time spent determining the most appropriate course of treatment.

For this reason, FDG sales are expected to grow from approximately $90 million in 2001 to more than $500 million in 2008. Growth will be supported by a number of factors, including the increase in the installed base of PET scanners, more FDG distribution centers, and higher utilization per facility.

At many early-adopter facilities, growing utilization has been driven by increased awareness and reimbursement for more clinical applications. Institutions that were equipped with a PET scanner in 1998 were likely to experience a doubling of procedure volumes by 2001. This trend is only expected to strengthen in 2003, with recently approved reimbursement for breast cancer indications.

New diagnostic products

Cardiology diagnostic products remained the largest revenue component of the diagnostic radiopharmaceutical market in 2001. Accounting for approximately 42% of diagnostic nuclear medicine procedures, the sector’s growth often dictates the fortunes for the entire radiopharmaceutical market.

The cardiology diagnostics segment has been aided by the increase in cardiovascular disease, as well as market trends such as relatively favorable reimbursement and price increases. But cardiology's share of the market is expected to decline as a number of new radiopharmaceutical applications are adopted.

These agents include:

- Altropane (Boston Life Sciences) -- Diagnosis of Parkinson's disease and attention deficit hyperactivity disorder (ADHD).

- Apomate (North American Scientific) -- Imaging cell death related to cardiology and oncology applications.

- Leutech (Palatin Technologies) -- Imaging various types of infections.

These agents may all have the potential to grow the overall market significantly, especially as potential applications widen. For example, Leutech was originally indicated for infection imaging related to appendicitis, but has most recently been explored as a possible agent to detect anthrax infection.

New therapeutic products

The therapeutics segment has historically been the most stagnant niche of the market, owing to the limited number of products and the clinical indications for which they can be used. However, the emerging sector of radioimmunotherapeutics is expected to drastically boost the market in upcoming years.

Powerful agents, composed of a monoclonal antibody or peptide in combination with a radioactive isotope, can attack certain types of cancer cells with an amazing ferocity. The radioactive component of the agent allows a greater range of killing, as antibody-antigen binding does not need to occur for every cell in order for it to be killed.

The first radioimmunotherapy product to hit the market, Zevalin, was introduced in February of this year. Zevalin’s manufacturer, IDEC Pharmaceuticals, has already experienced success with its immunotherapy product, Rituxan, which is expected to top $1 billion in sales in 2002.

Zevalin may fall short of this performance due to narrower clinical indications, but the agent may still be highly successful. In addition to Zevalin, several other agents are being studied in clinical trials, sponsored by four to five other manufacturers.

With gains expected in all elements of the market, signs point to an exciting future for radiopharmaceuticals.

By Monali PatelAuntMinnie.com contributing writer

July 24, 2002

Monali Patel is industry manager of medical imaging at Frost & Sullivan, a San Jose, CA-based market consulting and training firm (www.healthcare.frost.com). The data and analysis in this article are included in a recently published Frost & Sullivan report on the radiopharmaceuticals market: "The U.S. Radiopharmaceutical Market (A161-50)." For more information, contact Charlie Turnbow at 210-247 2472 or via email at [email protected].

Related Reading

3-D imaging in Europe: The jewel in the crown, May 30, 2002

The European PACS market: The best is yet to come, March 21, 2002

European CT community works to cut pediatric radiation dose, April 2, 2002

Digital x-ray market to hit $356 million by 2007, February 5, 2002

Copyright © 2002 AuntMinnie.com